Chapter 13

Chapter 13 Bankruptcy

A Ch. 13 Bankruptcy debtor proposes a repayment plan to pay creditors over a period of 3 to 5 years. The Plan is based on debtor’s projected income and expenses. The Plan may pay all or only a portion of the debt owed to creditors. The Court must approve the Plan.

Debtor makes Plan payments to the court appointed Trustee. The Trustee makes disbursements to the creditors from the Plan payments. Generally, debtor does not deal directly with creditors during her case. Debtor receives a Bankruptcy Discharge when she completes the Plan payments.

How Chapter 13 Bankruptcy Can Help?

- Stop Lawsuits

- Stop Wage Garnishments

- Stop Collection Calls

- Stop Foreclosure Proceedings and catch up your house payments over time

- Keep your car and catch up the payments over time

- Make payments to unsecured creditors, like credit cards and medical bills, based upon what you can AFFORD TO PAY and not what is owed

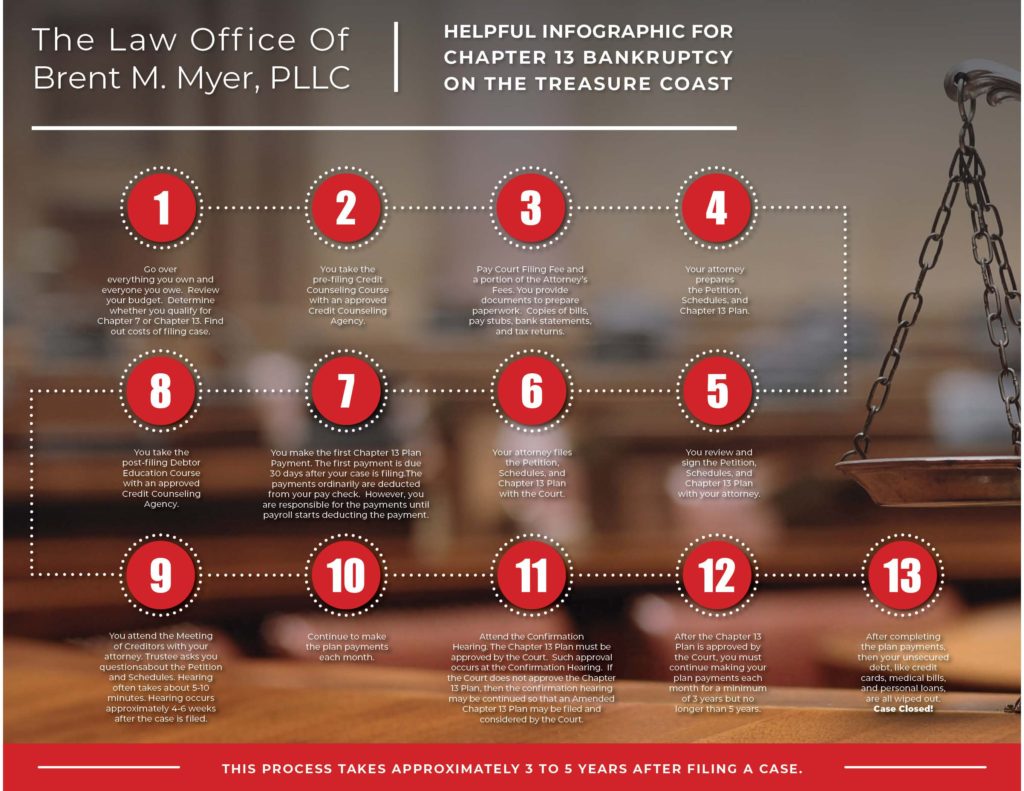

Chapter 13 Bankruptcy Roadmap

Bankruptcy law can be a complicated matter.

Let us help you figure it out!

Call our office today at (727) 487-9030

for your free consultation.

CONTACT TREASURE COAST BANKRUPTCY

FOR YOUR

FREE CONSULTATION

We are ready to review your case to see what options are available to you.

Someone will contact you shortly.